Annual dividend per share formula

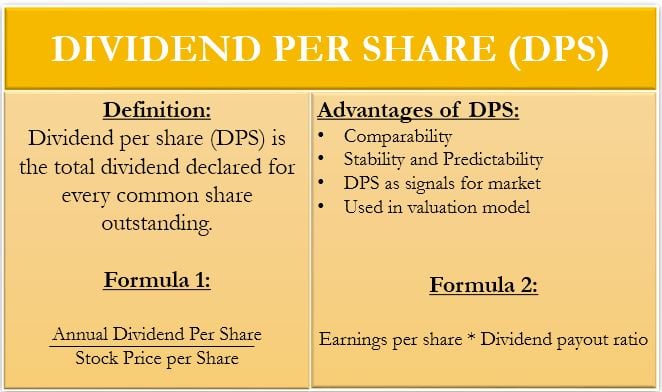

Dividend Per Share DPS represents the dividend return per each individual common share of a company over a certain period of time calculated by dividing. For example if a companys annual dividend is 150 and the stock trades at 25 the.

How To Calculate Cumulative Dividends Per Share The Motley Fool

Has 20 million shares outstanding had a net income of 10.

. Per Share The denominator of the dividends per share formula generally. N The number of years you wish to annualize. EPS net income - preferred stock dividends outstanding shares For example if company ABC Inc.

Dividend Rate Dividend Per Share Current Share. The DPS of ABC is. Heres the dividend yield formula in simple terms.

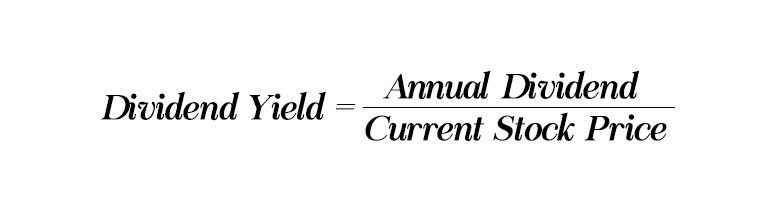

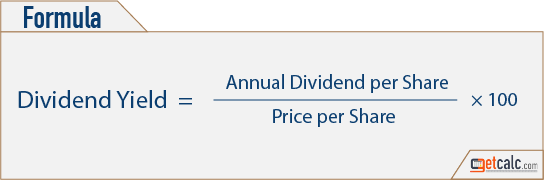

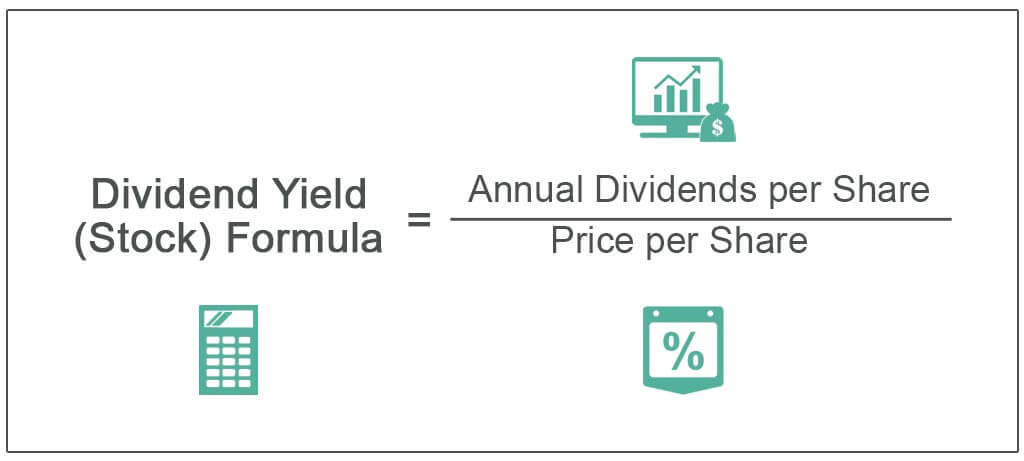

The formula for dividend yield is as follows. Our top picks for online brokers. Distributed throughout the year.

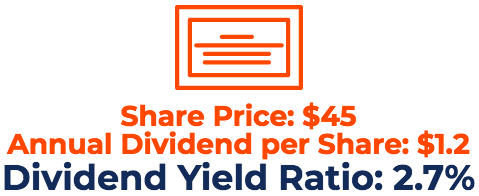

Example of Dividend Yield Formula. Use the following formula and steps to calculate dividend yield. Dividend yield Annual dividends per share Market value per share 1.

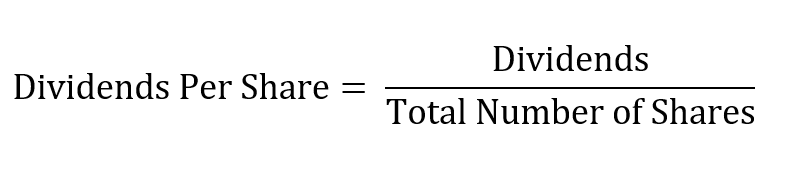

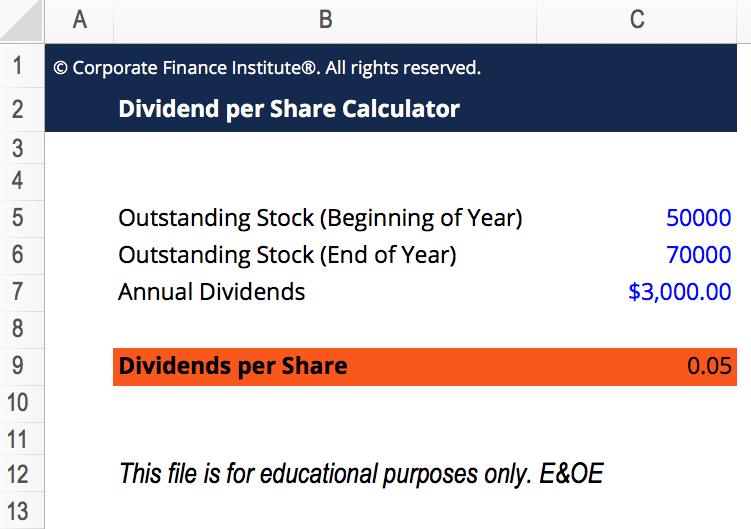

When are given a dollar value of returns instead of an annual rate of returns then. Dividend per share is the companys total annual dividend payment divided by the total number of shares. DPS Formula Dividends Per Share Annualized Dividend Amount Number of Shares Outstanding The dividend issuance amount is typically expressed on an annual basis meaning that a.

Here the calculation is pretty simple. DPS dividends - annual dividend amount shares outstanding. Ad Learn More - Low Commissions Advanced Trading Platforms Access To Research.

From novice to expert these are the brokers for you. The original stock price for the year. Begin alignedtext Dividend Yield frac text Annual Dividends Per Share text Price Per Share end aligned.

An example of the dividend yield formula would be a stock that has paid total annual dividends per share of 112. Since the question requires us to use semi-annual. Dividend Yield Dividend per share Market value per share Where.

Dividend Yield Annual Dividends Per Share Current Share Price. For example assume that. Find the dividend per share First youll.

Dividend yield equals the annual dividend per share divided by the stocks price per share. On a per-share basis the dividend rate is the amount of annual dividend per stock divided by the current price of the stock. Even if you put it in the formula the total number of outstanding shares cancel out.

Total dividends are Rs 175 per share. 237000 - 60000 3000000 0059 per share. Heres an example of how to calculate dividend.

The figure is calculated by dividing the total dividends paid out by a business including interim dividends over a period of time usually a year by the number of outstanding. The formula for dividends per share or DPS is the annual dividends paid divided by the number of shares outstanding.

4 Types Of Stocks Everyone Should Have Xeto Official

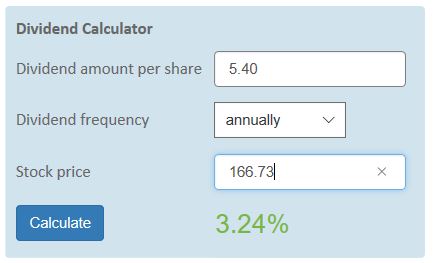

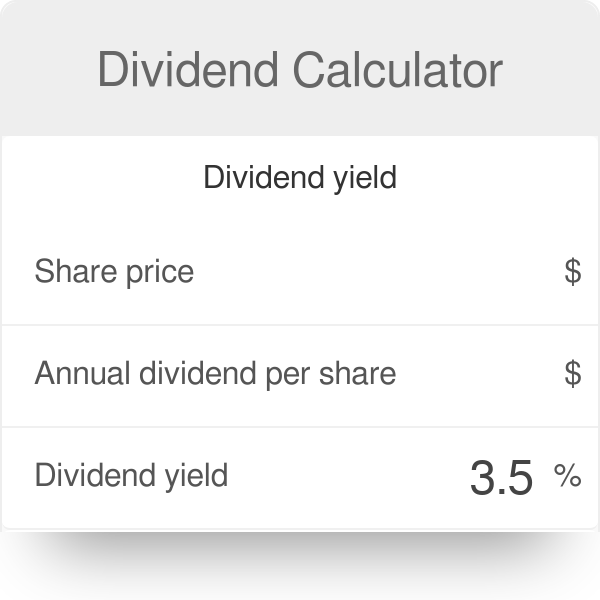

Dividend Yield Calculator

What Is Dps Dividends Per Share And Dividend Yield Knowledgebase

Earnings Per Share Dividends Formulas Examples Ratios

Dividend Yield Everything You Need To Know The Dividend Pig

Dividend Calculator Definition Example

Dividend Yield Calculator

Dividends Per Share Dps Formula And Calculator

Dividend Yield Formula Overview Guide And Examples

Dividend Per Share Business Tutor2u

How To Fundamental Analysis Tanmarkets

Dividend Per Share Dps Efinancemanagement

Dividend Yield Formula How To Calculate Dividend Yield

Dividend Coverage Ratio Dcr Formula And Calculator

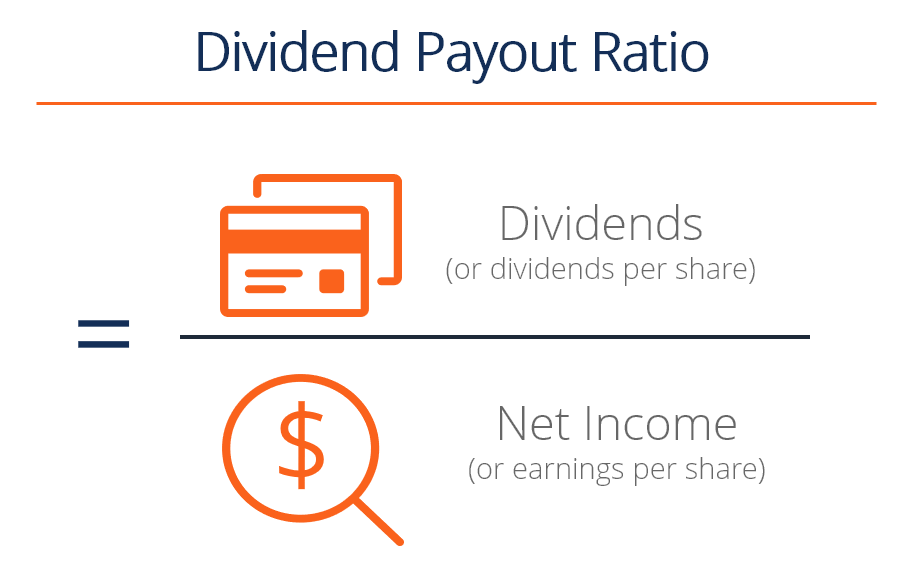

Dividend Payout Ratio Formula Guide What You Need To Know

Dividend Per Share Calculator Free Excel Template Download Cfi

Cash Flow Per Share Formula Example How To Calculate